Bank Of Canada Cbdc And Monetary Policy

To CBDC would speed up the bank run. The central bank can allocate transfers to agents based on their CBDC balances but the central bank cannot do so based on their cash balances because the central bank.

Joitmc Free Full Text Central Banks Digital Currency Detection Of Optimal Countries For The Implementation Of A Cbdc And The Implication For Payment Industry Open Innovation Html

Therefore the only policy that the central bank can implement with cash is to distribute the newly created cash evenly across all agents or through an Open Market Operation OMO exchanging cash by CBDC.

Bank of canada cbdc and monetary policy. The consequent impairment to financial intermediation would directly weaken the efficacy of monetary policy. 8 hours agoIn the accompanying Monetary Policy Report that contains the Bank of Canadas new forecasts policymakers also said upside risks to inflation have become a. The views expressed in this paper are solely those of the author and no responsibility for them should be attributed to the Bank of Canada.

13 hours agoThe Bank of Canada BoC is scheduled to announce its monetary policy decision this Wednesday at 1400 GMT and is expected to reduce government bond purchases to C1 billion a. First the ability of the central bank to implement monetary policy is different across these means of payment. By continuing to make central bank money attractive as a payment instrument in a digital world a central bank digital currency CDBC could help to maintain a countrys monetary sovereignty.

The interest on reserves and the interest on CBDC. First the ability of the central bank to implement monetary policy is di erent across these means of payment. Bank of Canada Presentation at the Economics of Digital Currencies Conference October 7 2020 Disclaimer.

We find that when it is in effect the interest on CBDC fully dictates the deposit rate and eliminates the pass-through from the interest on reserves to. 7 hours agoThe Bank of Canada took a major step in pulling back on the amount of stimulus it is providing to the economy on Wednesday by ending net new. As the economy reopens after the third wave of COVID-19 growth should rebound strongly.

Antonio Diez de los Rios Yu Zhu 2020. To achieve these criteria CBDC would be account-based and interest-bearing and the monetary policy. Monetary Policy Report July 2021.

10 hours agoBank of Canada maintains policy rate and forward guidance ends quantitative easing Media Relations Ottawa Ontario The Bank of Canada today held its target for the overnight rate at the effective lower bound of ¼ percent with the Bank Rate at ½ percent and the deposit rate at ¼ percent. Central Bank Digital Currency and Monetary Policy. Specifically we examine how in the presence of each other these two policy tools affect the rates and quantities of deposits and loans.

Mohammad Davoodalhosseini CBDC Monetary Policy 121. CBDC and Monetary Sovereignty Staff Analytical Notes 2020-5 Bank of Canada. A CBDC can allow for different interest rates on different balances or on different types of accountssuch as different rates for households than for businesses or for different sectors of the economy.

On the other hand researchers propose that CBDC could receive interest payments for the purpose of transmitting monetary policy. There are arguments for and against CBDC ideas are great on paper but full reform is. 11 hours ago21 mins Bank of Canada full statement and Monetary Policy Report Forexlive Bank of Canada rate decision for October 2021 Below is the full statement from the October 2021 Bank of Canada rate decision.

This cost summarizes in a reduced form the cost of adopting an electronic device working with the CBDC application or managing the CBDC. The Bank is forecasting growth of about 6 percent this year slowing to about 4 ½ percent in 2022 and 3 ¼ percent in 2023. 12 hours agoBooks and Monographs.

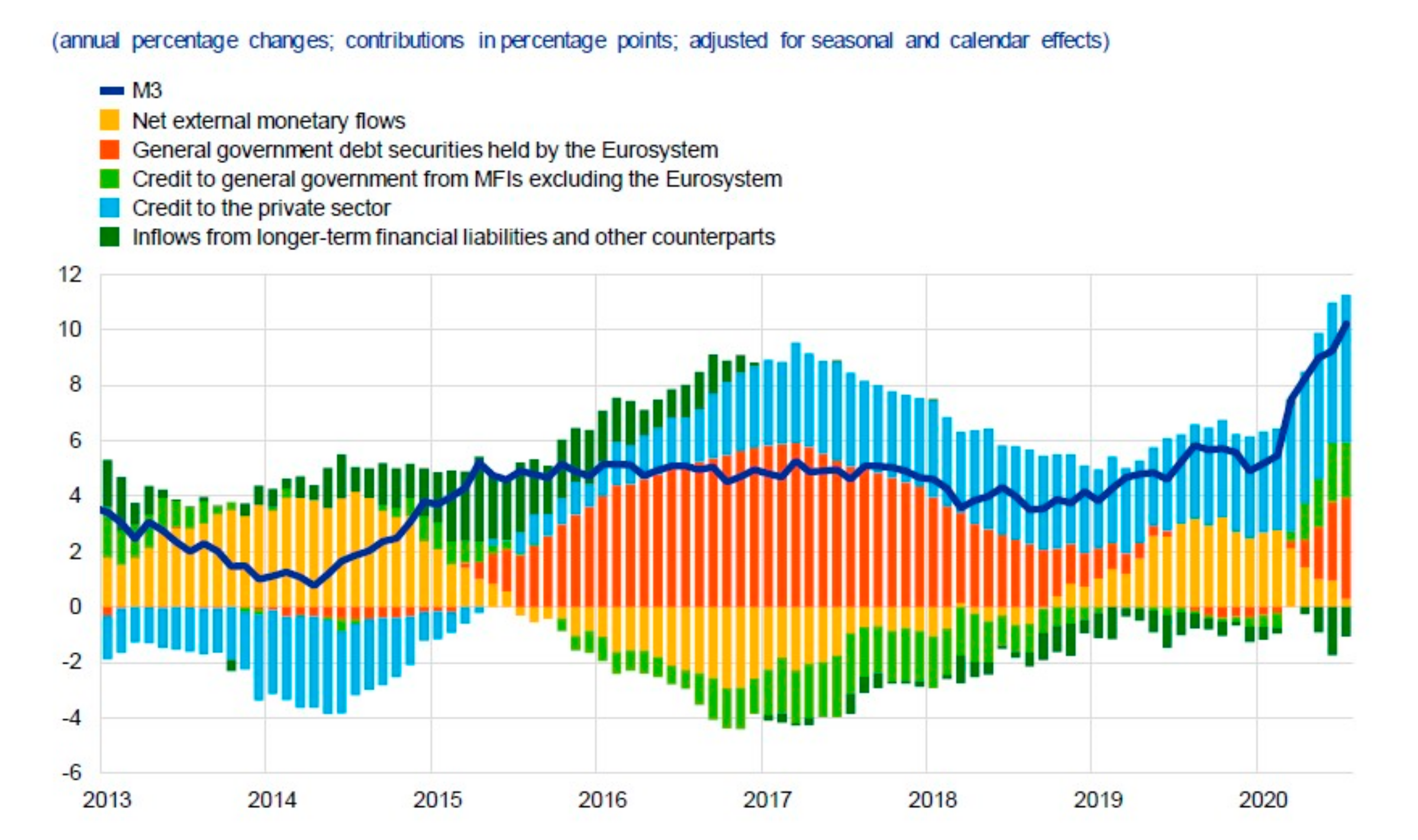

The Peoples Bank of China is supporting the development of global CBDC standards and working with other monetary authorities to launch a multi-CBDC arrangement because of this reason. 11 hours agoThe Bank projects global GDP will grow by 6½ percent in 2021 - a strong pace but less than projected in the July Monetary Policy Report MPR - and by 4¼ percent in. CBDC and Monetary Sovereignty - Bank of Canada.

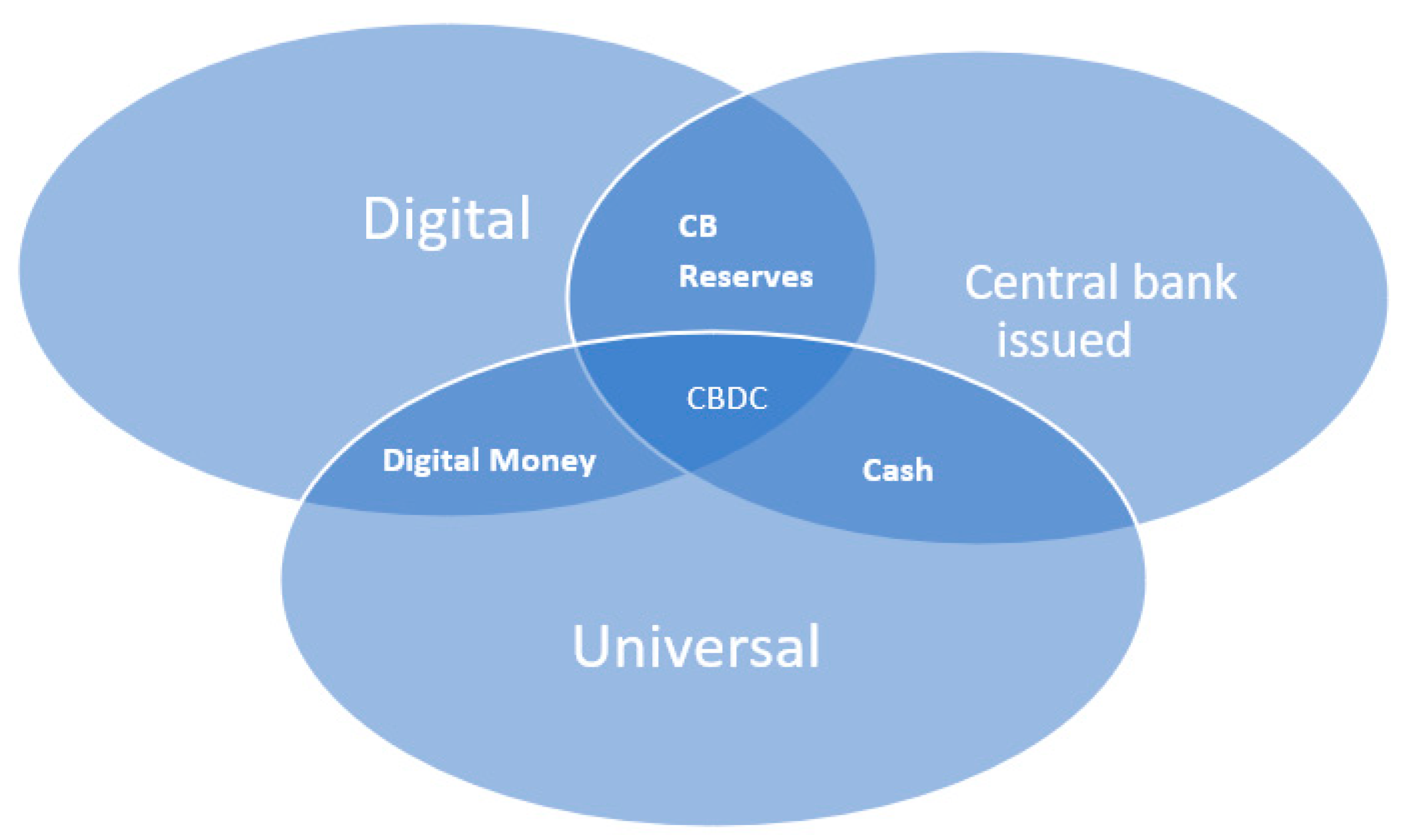

We consider how a central bank digital currency CBDC could transform all aspects of the monetary system and facilitate the systematic and transparent conduct of monetary policy. In particular we find that CBDC can serve as a practically costless medium of exchange secure store of value and stable unit of account. 5 Second carrying a CBDC is more costly for agents relative to cash.

The wide adoption of new means of payment denominated in the domestic currency would not threaten the central banks ability to implement monetary policyeven if this adoption. The Takeaway When it comes to CBDC it simply favours the already powerful and allows them more control over peoples lives and an even greater reduction of. Counter-cyclical Economic Policy OECD Economics Department Working Papers 760 OECD Publishing.

We discuss the effects or pass-through of two monetary policy tools. This could increase the constraints and reduce the effectiveness of central bank monetary policy Zhu and Hendry 2019. Douglas Sutherland Peter Hoeller Balázs Égert Oliver Röhn 2010.

I do however remain conscious of the negative points raised by research done by the Bank of Canada and agree any security breaches of its digital currency could potentially negatively affect the central banks reputation when it carries out its other functions such as conducting monetary policy and financial stability policy FungB. Summary of Government of Canada Direct Securities and Loans. Cash and CBDC are different along two dimensions in this paper.

This flexibility can help central banks implement monetary policy more effectively and achieve higher welfare. A CBDC if it is appropriately designed could counter the adoption of alternative means of payment. And services4 I study the optimal monetary policy when only one or both means of payment are available to agents.

List Of Banks In Liechtenstein With Their Official Information In 2021 Wonders Of The World Capital City Liechtenstein

5 Major Central Banks Which Have The Highest Interest Rates For More Free Forex Education Visit Http Forex Trading Tips Central Bank Forex Trading Strategies

Pdf Central Bank Digital Currency The Latest Challenge For The Theory Of Monetary Law

Legal Aspects Of Central Bank Digital Currency Central Bank And Monetary Law Considerations In Imf Working Papers Volume 2020 Issue 254 2020

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Fed S Evans Calls For Possible Revamp Of U S Financial Regulation In 2021 Financial Regulation Fiscal Monetary Policy

Sustainability Free Full Text The Future Of Money And The Central Bank Digital Currency Dilemma Html

Everything You Need To Know About Central Bank Digital Currencies Acheron Insights

Pdf Retail Central Bank Digital Currency Design Considerations Rationales And Implications Semantic Scholar

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

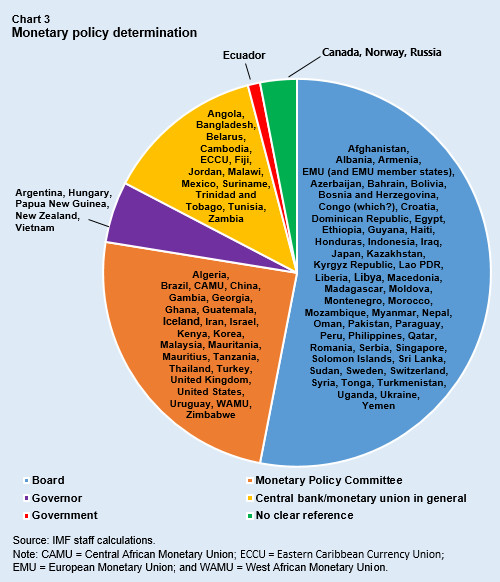

Imf Updates Central Bank Legislation Database

Pdf Central Bank Digital Currency Motivations And Implications

List Of Banks In Lebanon With Their Official Information In 2021 Financial Organization Lebanon Central Bank

Main Elements Of The Paper Download Scientific Diagram

Central Banks Board Members To Discuss Ways Of Better Using Blockchain In Cbdc Rollout Btcmanager Blockchain Central Bank Emerging Technology

Pdf Central Bank Digital Currencies Key Characteristics And Directions Of Influence On Monetary And Credit And Payment Systems

A Survey Of Research On Retail Central Bank Digital Currency In Imf Working Papers Volume 2020 Issue 104 2020

Legal Aspects Of Central Bank Digital Currency Central Bank And Monetary Law Considerations In Imf Working Papers Volume 2020 Issue 254 2020