Bank Of Canada Bond Tapering

Bank of Canada policy decision. It started buying 5 billion a week initially but has since tapered those purchases three times to bring it to the current level of 2 billion a week.

The Great Exit Central Banks Line Up To Taper Emergency Stimulus Reuters

This adjustment to the amount of incremental stimulus being added each week reflects the progress made in the economic recovery The overnight rate stays at 025 per cent.

Bank of canada bond tapering. Bank of Canada sees 2022 rate hike tapers bond-buying program. Shelly Hagan and Erik Hertzberg Bloomberg News. Advertisment The Bank of Canada has released its first guidance on how it.

We apologize but this video has failed to load. Bank of Canada BoC deputy governor Gravelle announced the end of many market support programs on Tuesday. Bank of Canada ends QE bond buying program a sign that higher rates are coming Canadas central bank is keeping its benchmark policy interest rate right where it.

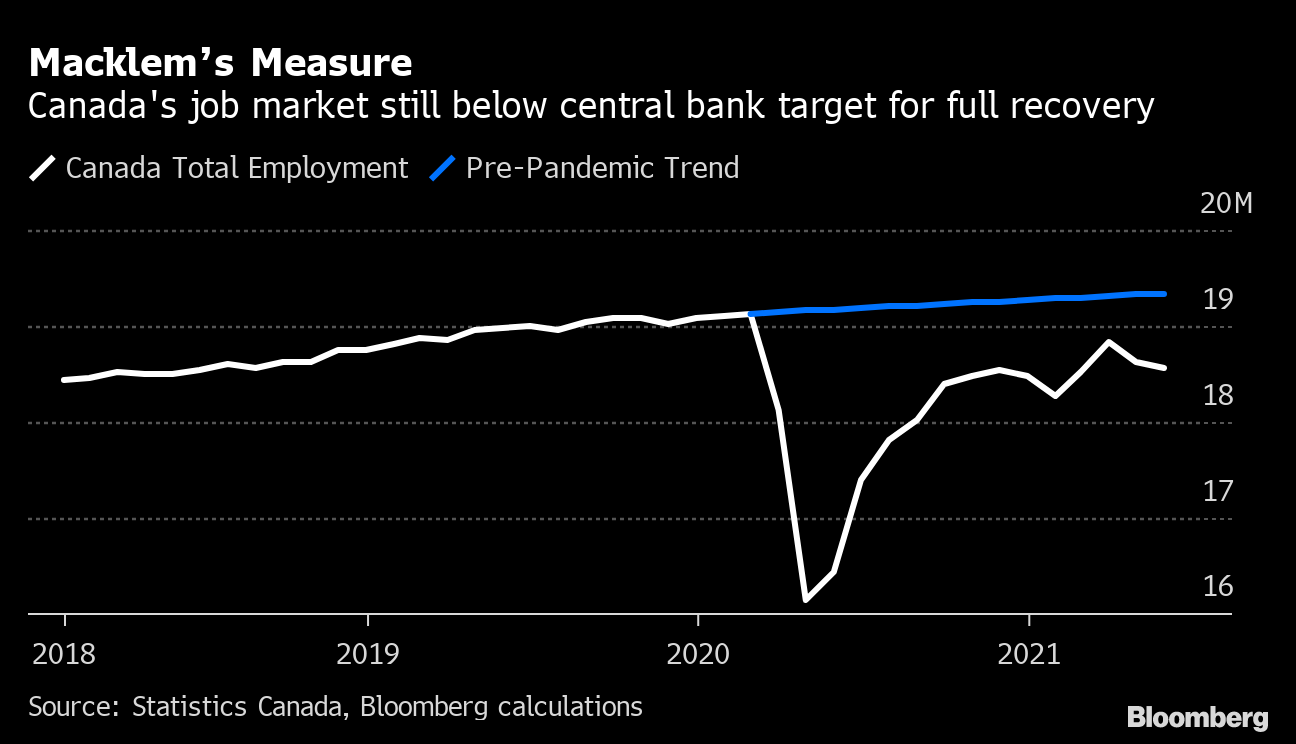

Former BoC governor David Dodge. The Bank of Canada has bought a net C320 billion in Canadian government bonds since the start of the pandemic and said it wants to hit a net-zero purchase level before it starts to consider raising rates. The Bank of Canada which already holds over 40 of all outstanding Government of Canada GoC bonds compared to the Fed which holds less than 18 of all outstanding US Treasury securities announced today that it would reduce by one-quarter the amount of GoC bonds it adds to its pile from C4 billion per week currently to C3 billion per week beginning April 26.

Investors brace for another Bank of Canada bond taper. The Bank of Canada BoC will set its policy on Wednesday at 1400 GMT two days after. Although the Bank of Canada rate decision and press conference does not get as much attention as the Federal Reserve yesterdays announcement was big and took the markets and many including me by surprise.

The Open BoC and Fed will react if there is ongoing inflation in 2023. Wednesday according to a survey of 17 economists. The Bank of Canada maintained its target overnight rate at its effective lower bound of 025.

The Bank of Canada BoC becomes the first central bank to signal an exit from stimulus and have begun tapering. The Bank of Canada BoC will set its policy on Wednesday at 1400 GMT two days after. Bank Of Canada To Raise Interest Rates Before Tapering Bond Purchases.

An improved economic outlook and growing confidence among central bankers have created the conditions in which the Bank of Canada is now comfortable paring back the pace of bond purchases by 3 billion. Sherry Cooper on 15 Jul 2021. Published July 12 2021.

Updated July 12 2021. Tapering bond purchases by 3 billion a week. It was just recalibrating the QE program to shift purchases towards longer-term bonds.

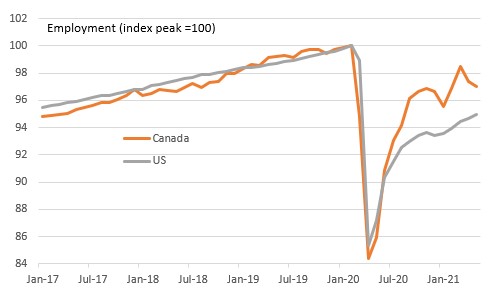

After all the signals coming from the jobs market had been clear. The central bank has bought 336 billion in Canadian government bonds under its asset purchase program also known as quantitative easing. Effective the week of April 26 weekly net purchases of Government of Canada bonds will be adjusted to a target of 3 billion said the Bank of Canada in a release.

This is the first meeting since then and expectations. As supports begin to taper overly easy credit is likely to disappear. Bank of Canada tapers bond-buying again.

Canada is on a solid economic recovery path. The Bank of Canada. A bond tapering story.

In July the BOC tapered its weekly QE pace to 2 billion from 3 billion in a continuation of an every-second-meeting slide in purchases. Bank of Canada Policy Meeting. Bond tapering The Bank of Canada cut its weekly net purchases of Canadian government bonds to a target of C3 billion 24 billion from C4 billion.

Another round of tapering warranted by a stronger outlook As widely expected the Bank of Canada reduced its weekly bond purchases by another C1bn today from C3bn to C2bn. It tapered its quantitative easing bond-buying program for the third time to net purchases of Government of Canada GoC bonds of 2 billion per week. Bank holds benchmark rate steady but winds down quantitative easing program.

The Ottawa-based central bank is unanimously forecast to cut its weekly purchases of Canadian government bonds by one-third to 2 billion US16 billion per week when it announces its policy decision at 10 am. The Bank of Canada is scaling back its massive asset purchase program known as quantitative easing while also while signalling higher interest rates and bigger variable mortgage payments might be coming sooner than previously expected. David Dodge senior advisor at Bennett Jones and former Bank of Canada governor joins BNN Bloomberg with his latest economic outlook.

Bank of Canada ends bond buying program a sign that higher rates are coming. The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether. In the US investors arent pricing in any rate hike by the Federal Reserve over the next year and only two over the next two years.

Effective the week of April 26 weekly net purchases of Government of Canada bonds will be adjusted to a target of 3 billion said the Bank. Bank of Canada policy meeting. A Bond Tapering Story.

This wasnt tapering it said. The Bank of Canada is telling us higher variable mortgage rates are probably coming sooner than expected. Bank of Canada expected to further taper bond purchases this week.

That matters for markets because it could provide a blueprint for other central banks said Ned Davis Research. The economy has improved meaning the gradual withdrawal of stimulus can now begin. The Canadian economy is improving faster than expected meaning supports can start fading.

The Bank of Canada has decided to reduce the pace of its bond purchases.

Bank Of Canada Holds Steady Ahead Of Possible July Taper Bloomberg

Bank Of Canada Holds Steady Ahead Of Possible July Taper Bloomberg

Bank Of Canada Sits Tight But Expect More Tapering Article Ing Think

Canada Business Sentiment Rebounded Before Second Wave Lockdowns In 2021 Rebounding Canada Vancouver Restaurants

Bank Of Canada Cuts Bond Purchases For Third Time Bank Of New Zealand Halts Quantitative Easing

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FLT3SALZCZJJ3JSW3KRTDGLLJU.jpg)

View Bank Of Canada Holds Interest Rate Says It Will Curb Bond Purchases Reuters

Bank Of Canada Becomes First To Signal Exit From Stimulus Bloomberg

Qe Party Over Bank Of Japan Stealth Tapers Further Bank Of Japan Japan Bank

Bank Of Canada Continues Taper Central Banking

Bank Of Canada Set To Dial Back Bond Buying Decision Day Guide Bloomberg

Bank Of Canada Set To Slow Its Bond Buying Ahead Of G 7 Peers Bloomberg

Baker Hughes Sees Slower U S Shale Drilling For Rest Of 2021 In 2021 Baker Hughes Shale Drill

Global Growth And Optimism Slide To Two Year Lows But Prices Rise At Record Rate Optimism Global Growth

Canada No Longer Needs Strong Stimulus Central Bank Says Raster To Vector Bank Jpg To Vector

Investors Seek Clues On Bank Of Canada S Next Taper Decision Guide

Pin On Semiotics September 2021

Once Crisis Tools Have Served Their Purpose Central Banks Should Scale Them Back By Wolf Richter For Wolf Street The Bank In 2021 Balance Sheet Bank Corporate Bonds